Sample Investment Portfolios for Different Goals

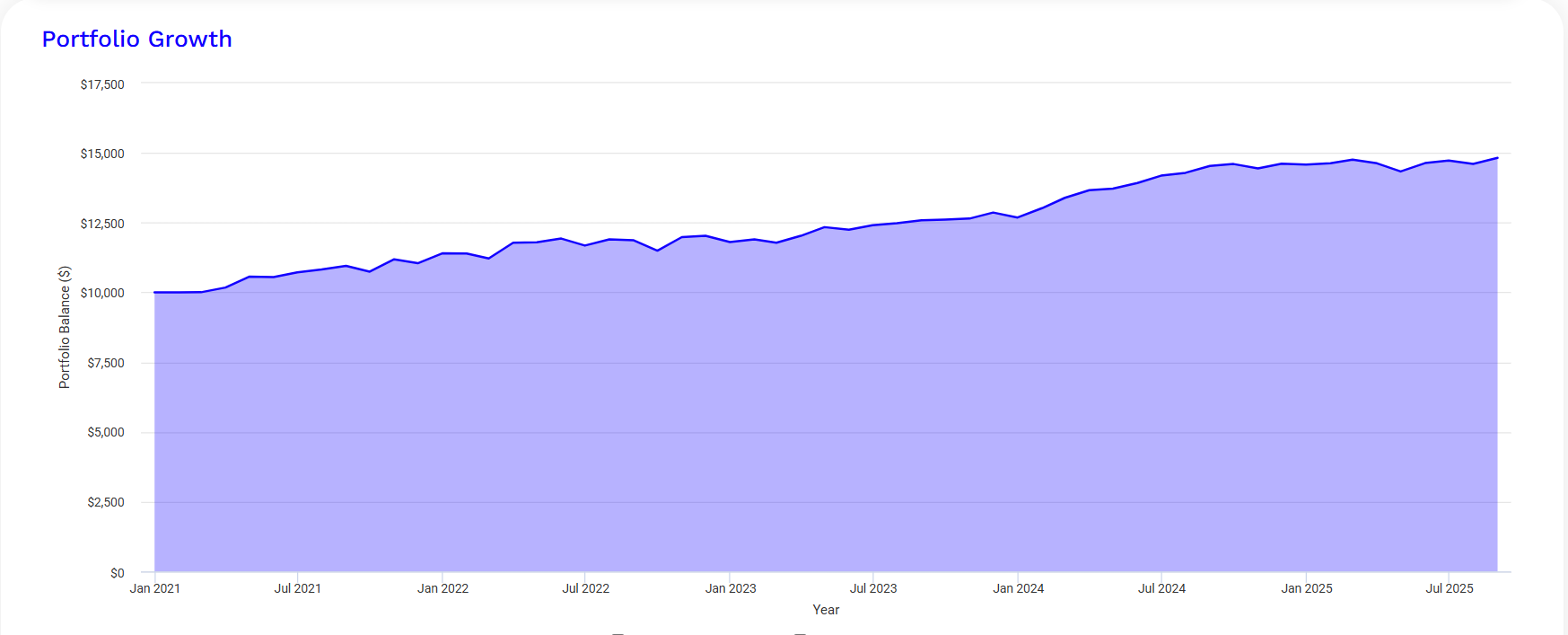

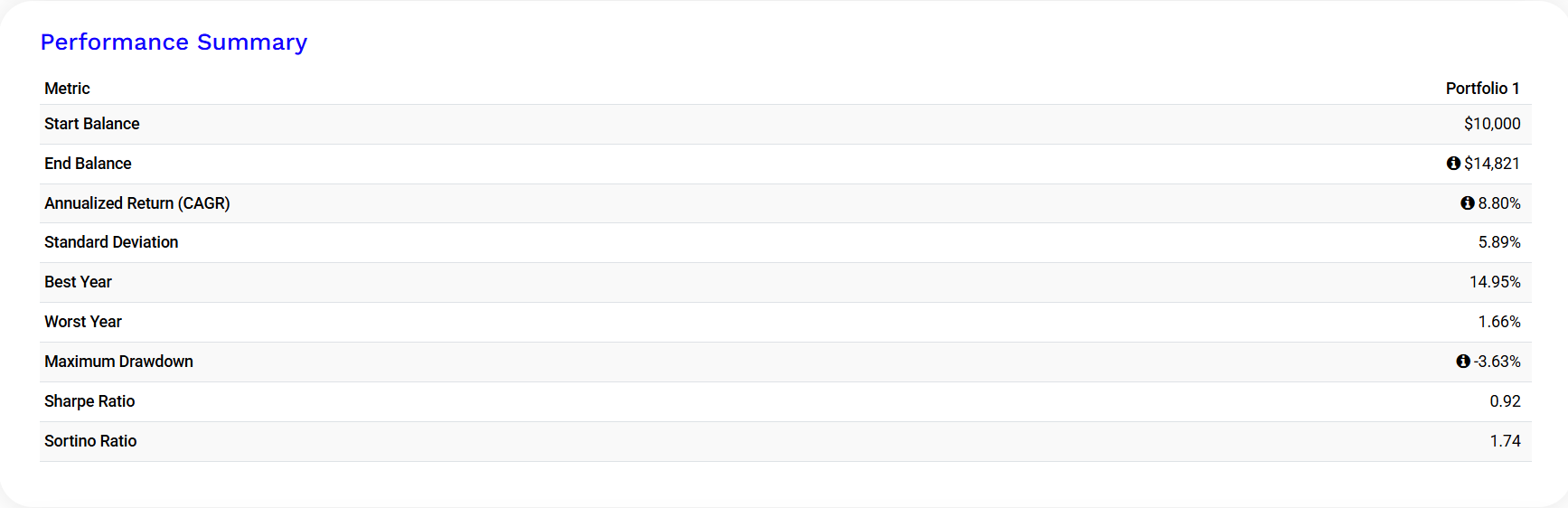

Cash-Plus Portfolio

Objective: Preserve capital over a 6-9 month horizon while generating modest returns.

The portfolio was launched at the end of 2022—a year when nearly all asset classes declined, except for the

US dollar. The unprecedented collapse of US Treasuries, which failed to protect equity investors due to surging

inflation, was a major blow.

The solution: a market-neutral portfolio with no exposure to bonds or gold.

The approach proved successful—this portfolio performs well in sideways or steadily rising equity markets.

It tends to underperform during sharp equity rallies. High inflation is not a threat to this portfolio’s structure.

The strategy remains relevant for the coming years. However, in 2025, the rapid equity rally has capped its return potential.

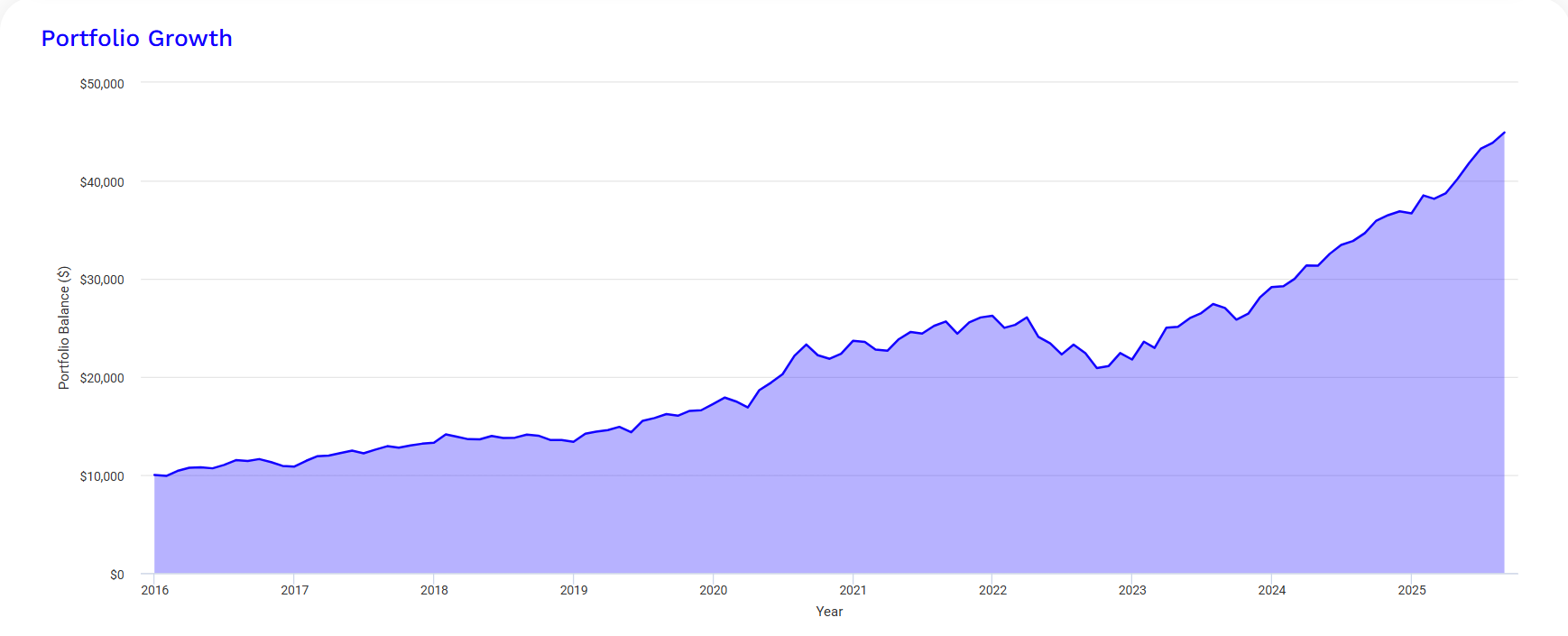

Optimist's Portfolio

Objective: Maximize returns by adding Bitcoin to a traditional portfolio.

The portfolio was launched in mid-2019 during a wave of crypto enthusiasm. It includes equities, bonds,

and a 4% allocation to Bitcoin. At the time, this was a bold and justified move.

This portfolio thrives in favorable macroeconomic conditions—especially during interest rate cuts. It is resilient to mild or moderate equity drawdowns but underperforms in high inflation environments.

It remains a forward-looking, multi-decade strategy.

However, the 4% crypto allocation should be monitored: at the first signs of a bursting crypto bubble,

it's advisable to reduce exposure to zero.

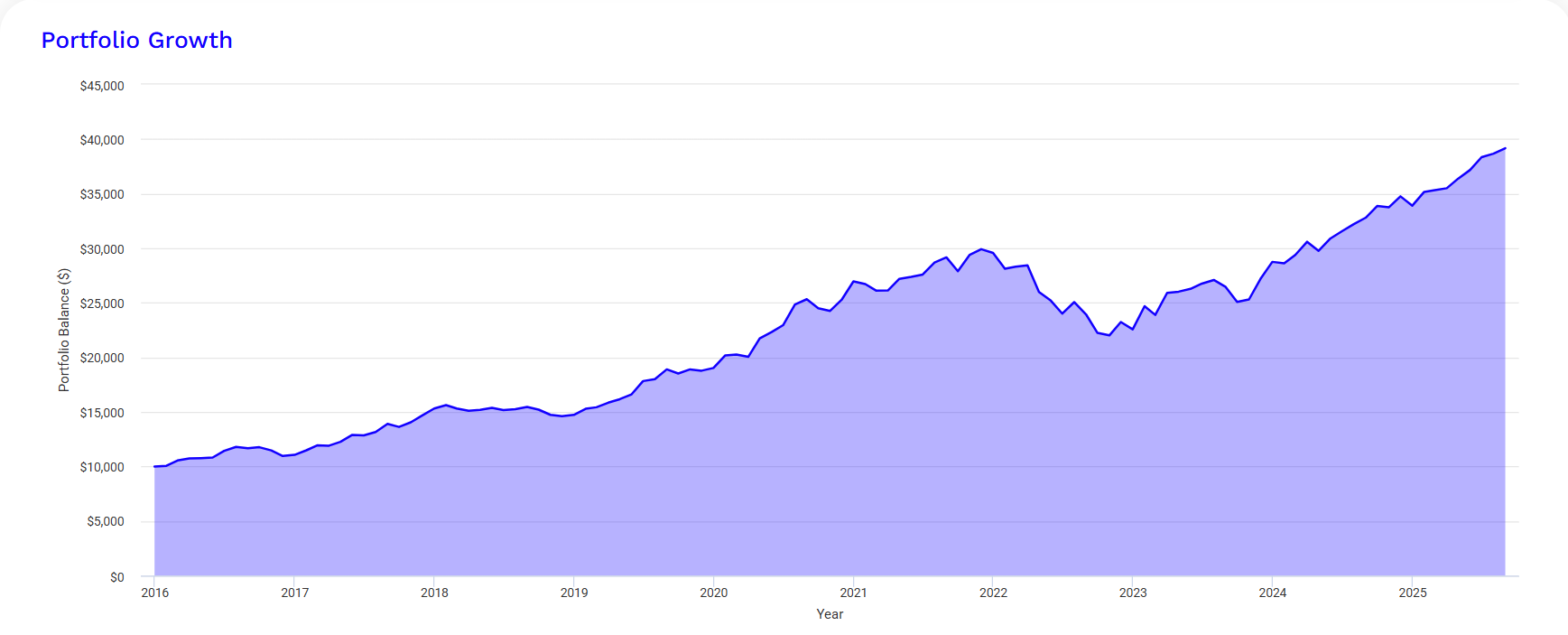

Bond-Free Pessimist's Portfolio

Objective: Achieve stable returns without any exposure to US Treasuries.

Continuous media chatter about a looming US debt crisis has led some investors to avoid government bonds altogether. This portfolio excludes not only US Treasuries but also foreign sovereign and corporate bonds.

It performs relatively well during sharp equity sell-offs

Its vulnerabilities lie in rising US real rates and a strengthening dollar. On the flip side, it benefits from

rising equity markets and a weakening dollar.

This strategy also remains viable for the next several decades.